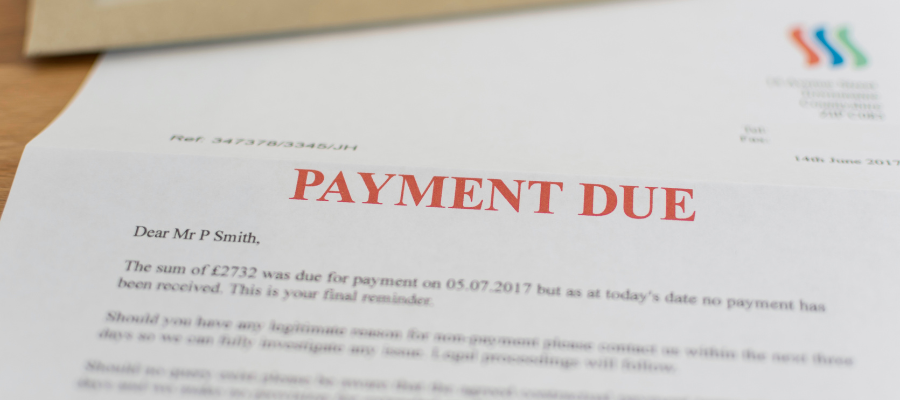

Are you owed money, but you’re not sure how to reclaim it? It can be difficult to know where to start when trying to reclaim the debt. A status report is a great way to start the process of getting what’s owed to you.

If you’re owed money, a status report can be a helpful way to keep track of the debt and make sure it’s repaid.

Read on to find out how a status report can be used to reclaim debts:

What Is a Status Report?

As anyone who has ever been in debt knows, it can be a stressful and frustrating experience. Constantly worrying about money can take a toll on your mental and physical health.

One way to ease some of this stress is to create a status report for the money you owe. This document will outline when the debt was incurred, how much is owed, and any payments that have been made towards the debt.

Having all of this information in one place will help you to keep track of your debt and see how much progress you are making in paying it off.

Additionally, seeing the numbers in black and white can help to give you a better sense of control over your financial situation. Why use a status report?

A status report is a record of the current status of a debt, including information on payments made and owed. This can be an important tool in reclaiming debt, as it provides a clear record that can be referenced at any time.

Additionally, a status report can help you keep track of payments made towards the debt and ensure that it is repaid in full. In some cases, a status report may also include information on interest owed or other charges.

What information should be included in a status report?

The first piece of information that should be included in your status report is the amount of money owed. This will give you a clear idea of the total amount of debt that you need to pay off.

What Payments Have Been Made?

Another important piece of information to include in your status report is any payments that have been made towards the debt. Keeping track of your payments will help you to see your progress.

This keeps you motivated to continue working towards paying off the debt. Finally, the current status of the debt should be included in your report. This will help you to keep track of which debts have been paid off and which ones are still outstanding.

By including all of this information in your status report, you will be able to get a complete picture of your debt situation and make informed decisions about how to move forward.

Keeping track of your debts is an important part of ensuring that you are making progress in paying them off, so make sure to include all of the relevant information in your next status report.

In Summary

Here’s a simple checklist for creating a status report:

- Determine the Purpose of the Report

When it comes to creating a status report, the most important thing is to determine the purpose of the report. What information do you need to communicate, and who is your audience?

Once you know the answer to these questions, you can start gathering data and organizing it in a way that will be easy for your reader to understand.

In general, a status report should include an overview of recent progress, as well as any challenges that have been encountered. It’s also helpful to provide a clear roadmap for what comes next.

- Decide What Information Should Be Included in the Report

When creating a status report, the first step is to decide what information should be included. Depending on the purpose of the report, this may include overview information such as project milestones and debtor’s finances.

Other key deliverables are also included, as well as more detailed data such as progress against specific objectives.

Once you have determined the scope of the report, you will need to gather the relevant information from team members and other sources.

Once all of the data has been collected, it can then be compiled into a format that is easy to read and understand. This will help you in the process of recovering the debt.

- Gather the Necessary Information

Creating a status report may seem like a daunting task, but with a little planning, it can be easily accomplished. The first step is to gather the necessary information.

This includes data on what has been accomplished, what tasks are currently in progress, and what obstacles have been encountered. Once you have all of this information, you can begin to write your report.

Be sure to include a clear and concise executive summary, as well as detailed breakdowns of each section. Create the report using a word processing or spreadsheet program

- Save the Report for Future Reference

Status reports are a necessary evil in today’s business world. By their very nature, they are dry and often filled with jargon that is difficult to decipher.

However, they can be an invaluable tool for keeping track of projects and ensuring that they are on track.

By following these simple guidelines, you can create a status report that is both informative and easy to understand.

Ready to Put Your Status Report Together?

A status report is an important document when it comes to reclaiming money that is owed to you. By using this document, you can ensure that the process goes as smoothly as possible and that you get your money.

If you are in need of professional assistance. Here at Able investigations, we have a trained team of individuals ready to help you get your money back. Get in contact with us today to speak to an expert.

Comments are closed.